How to Find Owners of Properties

in Michigan

A property owner search in Michigan becomes necessary for various reasons. You could be considering an investment and want to contact the owner to make an offer. Perhaps you have an upcoming infrastructure project and need to notify the property owner.

Whatever your reason, you need to know who owns a certain property in Nevada. So, what are your options? Here are proven ways to find the owner of a property by address in Michigan.

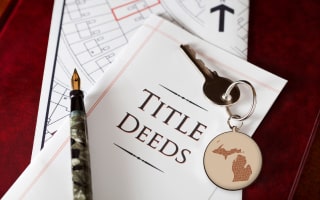

Visit the Register of Deeds

The Register of Deeds office serves as the official repository for all legal documents impacting real property. These documents include;

- Deeds

- Mortgages, mortgage assignments, and mortgage discharges

- Land contracts

- Lien releases

- Easements

- Rights of way

- Oil and gas leases

- Subdivision plats

- Surveys

Once they record a deed, it enters the public record, making it accessible for anyone to review or copy. The office doesn't keep the original deed or mortgage; instead, the transaction is logged in a liber, which is stamped on the document itself.

Check the State Archives

Under specific federal laws, Michigan gained the authority to sell land and allocate the proceeds for designated purposes. The initial buyer of such land received a numbered certificate as proof of purchase. This certificate was later surrendered in exchange for a land patent, which was then entered into the County Register of Deeds records.

At the time of issuance, each certificate's number was logged in the matching plat book, while the land patents included volume and page details linked by the certificate number. You can request certified copies of these land patents.

Ask Your County Assessor

Tax assessor records contain valuable information, such as a property's current and previous deeds. These records are kept by the tax assessor's office in the county or city where the property is located. While some areas provide online access to these records, it's often necessary to call the office to request specific documents for a title search.

In some cases, a title searcher may need to visit the tax assessor's office in person to obtain the required information. Here are some of Michigan's county assessors:

Use the Property Search Portal

Some Michigan counties have portals where property searchers can simply enter details of the property they want to search. Looking to find the owner of a property free? You are in luck because some Michigan property search portals are free to use.

Here are some property search portals where you can find a property owner by address in Michigan:

Outsource to a Title Search Company

A property owner search in Michigan can be complex, particularly when researching multiple properties across various counties. Many key documents may not be available online, requiring you to search through several databases. To obtain complete title records, you may even need to visit the courthouse to access physical copies.

Self-conducted searches often require close interpretation due to a lack of standardized formats. On the other hand, title companies provide easy-to-read reports, making it simpler for property owners and buyers to understand the information.

Working with a title search company simplifies this process, saving you the time and effort of navigating both digital and physical records.

![]() Hire a Commercial Service Provider

Hire a Commercial Service Provider

Commercial service providers like PropertyChecker.com make property owner search in Michigan much easier. PropertyChecker.com provides access to a comprehensive, regularly updated database of all properties in the state, with multiple search options available.

You can find the property owner by address, parcel ID, phone number, or email. The platform not only identifies current and past owners but can also reveal ownership details concealed within legal or business entities.

What Are the Different Types of Property Ownership in Michigan?

In Michigan, there are different ways to own property, each with its own benefits and limits based on the needs of the owners. You can own property solely or with co-owners. How you and your co-owners hold title affects estate planning and probate. If one owner dies, each type of co-ownership gives the surviving owners different rights.

Some forms of co-ownership allow the deceased owner's share to pass directly to the surviving co-owners without going through probate. Co-ownership also brings financial and personal considerations. When relationships between co-owners change, or one owner passes away, property ownership can quickly become confusing and even lead to conflicts. Here are different ways of owning property in Michigan:

-

Sole Ownership

In this type of ownership, one person or entity fully owns the property without any co-owners. However, in Michigan, there's a rule for sole ownership in the case of married couples.

If the owner takes out a mortgage that isn't a purchase money mortgage, meaning it's not specifically for buying the property or is above the purchase price, the non-owning spouse must also sign the mortgage. Also, when the property is sold, the non-owning spouse has to sign any deed that releases their interest in the property.

-

Tenancy in Common

When individuals own property as tenants in common, each person has an undivided interest in the property and equal rights to use the entire space. When a property is transferred to multiple individuals without specifying how the title is held, it is usually assumed to be a tenancy in common.

When one owner in a tenancy in a common arrangement dies, the surviving owner doesn't automatically gain full ownership. Instead, the deceased owner's share goes to their heirs, either through an estate plan or probate. This can create issues for both the surviving owner and the new co-owner.

If the owners disagree on how to manage or sell the property, they may end up in a costly and time-consuming court battle called a partition action. This type of lawsuit seeks to resolve the conflict by selling the property and dividing the proceeds based on each owner's share.

-

Joint Tenancy

As joint tenants, two or more people share ownership of a property, each holding an equal, undivided interest. One key difference from tenants in common is the right of survivorship. This means that when one co-owner dies, their share automatically passes to the surviving owners without going through probate.

However, this advantage can be affected if there are more than two co-owners and one decides to sell their interest. When one co-owner divests their interest, it can sever the joint tenancy, potentially changing how ownership is managed among the remaining owners.

When conveying real property, the deed must explicitly state that the owners hold it as joint tenants; otherwise, tenancy in common is usually assumed. It's also important to recognize that in Michigan, joint tenancy operates differently for personal property than for real property.

-

Joint Tenancy with Full Rights of Survivorship

This arrangement is similar to a joint tenancy but includes specific language that prevents the severance of one owner's interest. It is established by conveying the property to two or more people as joint tenants with full rights of survivorship. In this case, only an action by all co-owners can destroy the right of survivorship.

When a joint tenant with full rights of survivorship dies, their share automatically passes to the surviving co-owner(s), and any will, trust, or other document expressing the deceased's wishes does not change that.

The interest of a deceased joint tenant, whether they held full rights of survivorship or not, does not go through probate. Typically, recording a certified copy of the death certificate at the Register of Deeds office is all that's needed to remove the deceased joint tenant's interest.

-

Tenancy by the Entirety

The final type of joint ownership in Michigan is known as tenancy by the entirety, and it is available only to married couples. This arrangement offers several legal benefits. Like joint tenancy with rights of survivorship, tenancy by the entirety grants rights of survivorship for both spouses. This means that if one spouse passes away, the other automatically becomes the sole owner of the property with a 100% interest.

Tenancy by the entirety also allows a married couple to treat their property as a single legal entity. Creditors cannot attach or sell the interest of one spouse individually. This arrangement also protects the property from liens if one spouse is sued and a judgment is obtained against them.

Here is a summary table of the various forms of property ownership in Michigan:

| Ownership Structure | Description | Benefits | Implications |

|---|---|---|---|

| Sole Ownership | A single individual or entity holds full ownership of the property, with no other co-owners. | Total control over the property | When the property is sold, the non-owning spouse has to sign any deed that releases their interest in the property. |

| Tenancy by Entirety | Available only to married couples | Creditors cannot attach or sell the interest of one spouse individually. | A deed transferring real estate to spouses must explicitly declare a right of survivorship in this form of co-ownership |

| Joint Tenancy | Two or more people hold joint titles to a property. | When one co-owner dies, their share automatically passes to the surviving owners without going through probate. | Michigan joint tenancy operates differently for personal property than for real property.. |

| Joint tenancy with full rights of survivorship | Established by conveying the property to two or more people as joint tenants with full rights of survivorship. | When a joint tenant with full rights of survivorship dies, their share automatically passes to the surviving co-owner(s). | Only an action by all co-owners can destroy the right of survivorship. |

| Tenancy in Common | Each person has an undivided interest in the property and equal rights to use the entire space. | Each owner, or tenant, holds a stake in the entire property, regardless of how large their individual share is. | When one owner in a tenancy in a common arrangement dies, the surviving owner doesn't automatically gain full ownership. |

Common Methods of Property Transfer in Michigan

A deed is any legal instrument that transfers ownership interest in an asset to a new owner. While these one-page documents may seem straightforward, a deed involves much more than it appears at first glance.

Various types of deeds convey different interests in real property, and the specific language used in each deed plays a crucial role. It's important to understand that a deed is not the same as a title; rather, it serves as the means to transfer the title of an asset. In Michigan, the three primary types of deeds are warranty deeds, quitclaim deeds, and covenant deeds.

-

Warranty Deed

A warranty deed offers the highest level of protection or covenants to a grantee with its extensive warranty coverage. This warranty reaches back through the property's entire history, addressing any ownership issues that existed even before the grantor obtained the property.

Warranty deeds ensure that the title is free from liens, debts, or encumbrances. The grantor is responsible for resolving any future title issues that may arise.

-

Quitclaim Deed

Of all the deeds in Michigan, quitclaim deeds offer the least protection to the grantee. A quitclaim deed does not provide any assurance of a clean title, meaning the grantor is not liable for any claims or interests against the transferred property.

Even without such guarantees, quitclaim deeds remain valid in Michigan because there are situations where the grantee may not require protection against title issues. Examples of scenarios where a quitclaim deed would be ideal to include transfers to:

- A family member

- An ex-spouse after divorce

- A charity or a friend

- A living trust

- A business owned by the grantor

-

Covenant Deed

In contrast to quitclaim deeds, covenant deeds offer a certain level of protection to the grantee. A covenant deed in Michigan guarantees that the property is free from title issues, but only for the time the grantor owned it. The grantor is not responsible for any hidden or pre-existing problems that existed before their ownership.

Covenant deeds are a practical choice for transferring title when the grantor does not plan to occupy the property and has never used it in the past. For instance, in foreclosure situations, a covenant deed can speed up the sale process by removing the need for the bank or financial institution to address any title issues that arose from the previous owner.

Step-by-Step Guide to Property Transfer in Michigan

Here is the general process of transferring property ownership in Michigan:

- Gather requisite documents: Start by checking the current title of the property to obtain its legal description. Gather all necessary forms, including a deed template.

- Complete the deed form: Fill out the necessary details for a deed, such as the information about the grantor, grantee, and a legal description of the property.

- Sign the deed: As the grantor, ensure you sign the deed. According to Michigan law, the grantor can sign the deed in the presence of a notary, a court clerk, or a judge.

- File the deed: Michigan law requires that deeds be recorded with the Registry of Deeds in the county where the property is located rather than in the county where the transaction occurred or where either party resides.

- File property transfer affidavit: The buyer is required to submit a property transfer affidavit to the assessor for the township or city where the property is located. This form serves to confirm their acceptance of the property.

Michigan Homeowner Lookup

- Owner(s)

- Deed Records

- Loans & Liens

- Values

- Taxes

- Building Permits

- Purchase History

- Property Details

- And More!